Gold has long been considered a symbol of wealth and stability, transcending cultures and eras as a universally recognized store of value. Among the various forms of gold, bullion bars stand out as a preferred investment for those seeking to preserve and grow their wealth. This article delves into the bullion bars world of bullion bars, exploring their significance, how they differ from other gold products, and why they are a crucial asset in an investor’s portfolio.

What Are Bullion Bars?

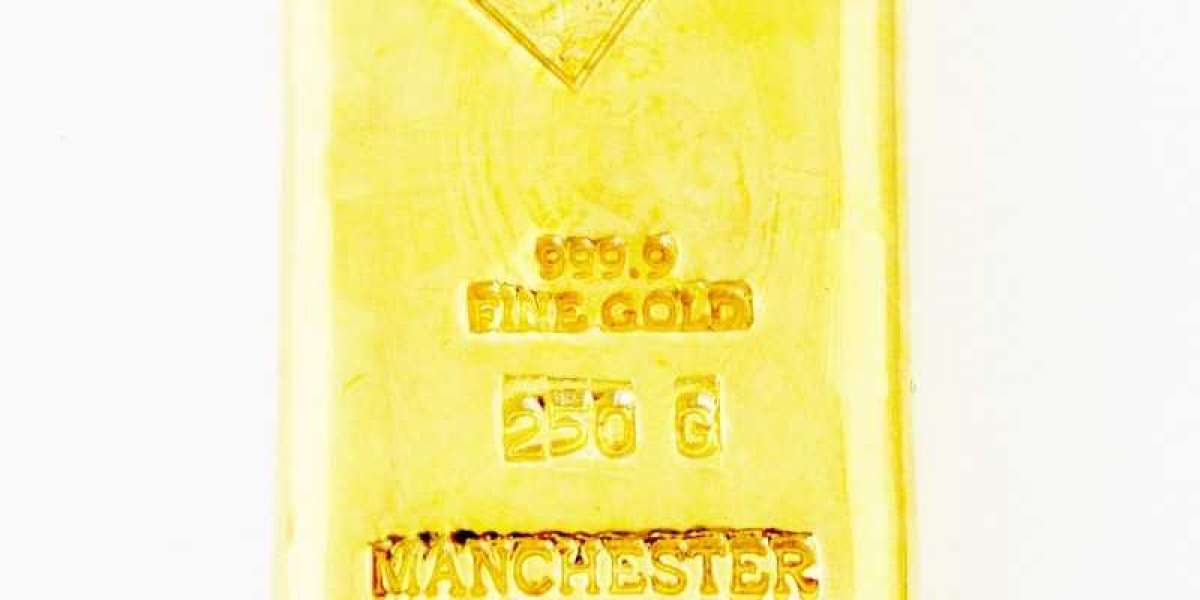

Bullion bars are gold bars of various sizes, shapes, and weights that are produced by recognized mints or refineries. These bars are typically made from pure gold, with a fineness of 999.9 (24 karats), meaning they contain 99.99% gold. The remaining percentage usually consists of trace amounts of other metals, which are present due to the refining process.

Bullion bars are distinct from other forms of gold, such as coins or jewelry, primarily due to their simplicity and lack of intricate designs. While gold coins may carry numismatic value (value beyond the gold content due to rarity or historical significance), bullion bars are valued solely for their gold content, making them a straightforward investment vehicle.

Why Invest in Bullion Bars?

Purity and Value: Bullion bars offer a high level of purity, which is crucial for investors. The value of a bullion bar is directly tied to the current price of gold in the market, making it an attractive option for those looking to invest in physical gold.

Lower Premiums: Compared to gold coins, bullion bars generally come with lower premiums. This means that the price above the spot price of gold is less, making bullion bars a cost-effective way to invest in gold.

Diverse Weight Options: Bullion bars are available in a wide range of weights, from as small as 1 gram to as large as 1 kilogram or more. This variety allows investors to tailor their purchases according to their budget and investment strategy.

Liquidity: Gold bullion bars are highly liquid, meaning they can be easily bought and sold in markets around the world. This liquidity makes them a flexible asset for investors who may need to convert their gold into cash quickly.

Wealth Preservation: In times of economic uncertainty or inflation, gold is often seen as a safe haven. Bullion bars, as a form of physical gold, offer a tangible asset that can help preserve wealth when other investments might be losing value.

How to Buy Bullion Bars

When purchasing bullion bars, it’s important to buy from reputable dealers to ensure the authenticity and purity of the gold. Buyers should look for bars that come with an assay certificate, which guarantees the bar’s weight, purity, and authenticity. The most recognized mints and refineries include the Royal Mint, Perth Mint, PAMP Suisse, and Valcambi, among others.

Investors can purchase bullion bars from online dealers, local gold shops, or even at auctions. It’s crucial to compare prices and check the dealer’s reputation before making a purchase. Additionally, storage should be a consideration; while some investors prefer to store their gold at home, others bullion bars might opt for secure storage facilities that offer insurance and protection.

The Future of Bullion Bars

The demand for bullion bars continues to grow as investors seek reliable ways to safeguard their wealth. With the ongoing global economic uncertainties and fluctuating financial markets, gold remains a stable and enduring asset. Bullion bars, with their simplicity and intrinsic value, will likely remain a cornerstone of gold investment for years to come.

Whether you’re a seasoned investor or new to the world of gold, bullion bars offer a straightforward, tangible way to invest in one of the world’s most enduring assets. As a reliable store of value, they provide peace of mind in an unpredictable economic landscape.

By understanding the significance and benefits of bullion bars, investors can make informed decisions that align with their financial goals, ensuring that their wealth is preserved and potentially grown through the timeless value of gold.